TORONTO -- The former top brass at Nortel had opportunities to correct inaccurate accounting at the now-defunct telecom giant, but instead allowed "monkey business" to continue to trigger big bonuses for themselves, prosecutors in the high-profile trial said in closing arguments Friday.

The Crown argues that three former Nortel executives were intentionally deceitful when they did not correct known "errors" in the company's financial books, nor alert the firm's board of directors and outside auditors Deloitte & Touche about them.

"The bottom line is... that's where the monkey business was taking place," Crown attorney David Friesen told the Ontario Superior Court.

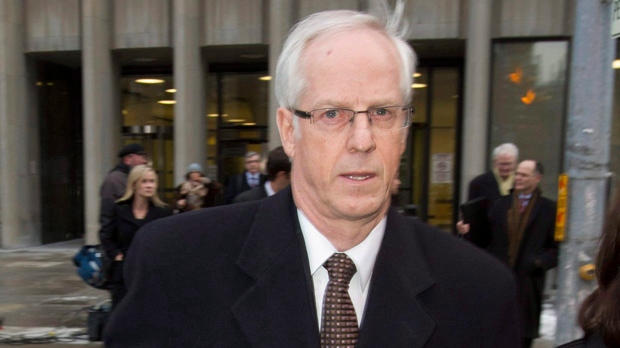

Nortel's ex-CEO Frank Dunn, ex-CFO Douglas Beatty and ex-controller Michael Gollogly are accused of two counts of fraud each for allegedly manipulating financial statements in 2002 and 2003 to show a return to profitability when the technology company was losing money.

The former executives have been on trial since January. All three have pleaded not guilty to the charges.

Prosecutor Amanda Rubaszek told the court that in September 2002, the executives were aware of an internal report from the company's own accountants that detailed $303-million in excess accruals -- or cash reserves set aside to cover future liabilities -- on Nortel's balance sheet but did not share this information with the board or auditors.

Documents show that in February 2003, the company once again had $189 million in accounting reserves but released only $80 million during the first quarter of that year. The Crown argues only that specific amount was released in order to meet the threshold that triggered bonus payments.

The return to profitability plan was created as an incentive for the executives after Nortel lost billions of dollars when the technology bubble burst in 2001.

Rubaszek said even though many in the firm may have known that the balance sheets were inaccurate, ultimately it was the responsibility of the accused to flag these concerns and not approve them.

Dunn, Beatty and Gollogly are all experienced businessmen, with financial expertise, and should've known that it goes against regulatory rules to tamper with a company's financial records to "help the bottom line," head Crown attorney Robert Hubbard charged.

He said decisions about the statements were knowingly being made "independent of any economic activity."

The defence will begin their closing submissions Tuesday.

In a 335-page factum filed to the court last week, the defence argues that the bulk of the Crown's evidence -- emails, boardroom meeting minutes and quarterly financial projections and results -- show only that errors were made and do not prove intent or that a conspiracy had been orchestrated.

At the time, the company was undergoing a massive restructuring that made keeping track of changes at its various divisions more difficult, the defence has argued.

It adds there is no evidence the accused ever asked anyone to create false financial statements and no fraud took place because the company's quarterly balance sheets, including the release of accruals, had been approved by outside auditors, they claim.

The accused were fired from the company in 2004 over the fraud allegations. Five years later, Nortel filed for bankruptcy in Canada and the U.S.

At its height, the Ottawa-based firm had 90,000 employees worldwide and was one of the foremost leaders in the telecom equipment industry.

Since the bankruptcy, the company has sold off about US$7.7-billion in assets, in one of the largest asset sales in Canadian history.