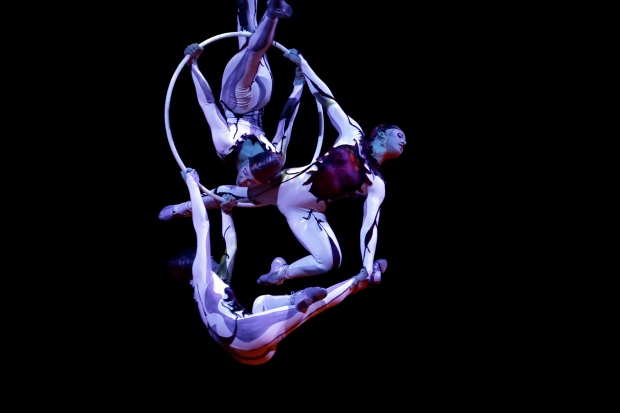

MONTREAL -- The force behind Cirque du Soleil's nearly 31-year run as a world-renowned Canadian success story is selling the famed circus even though his seven-year-old daughter has dreams of one day becoming a clown.

"I truly don't believe in second-generation entrepreneurship," Guy Laliberte told a news conference on Monday after announcing the sale to a U.S. private equity firm.

Laliberte, 55, has five children between the ages of seven and 18, but said that having them take over the Cirque was never really an option.

"From the outset, I didn't want to put the pressure of running the circus on their shoulders."

The creator of the Cirque, which wowed the world with breathtaking and cutting-edge shows, will maintain a 10 per cent stake in the Montreal-based company through his family trust and will also continue to provide strategic and creative input.

Equity firm TPG is acquiring a 60 per cent stake for an undisclosed price. Chinese investment firm Fosun will have a 20 per cent stake and Quebec pension fund manager the Caisse de depot another 10 per cent.

The transaction -- which Laliberte said wasn't a "fire sale" at a reported value of around $1.5 billion -- will also see partner Dubai World sell its 10 per cent stake.

After building the Cirque into a major success story in the business and entertainment worlds, Laliberte said he wanted to pursue other undisclosed creative challenges. He added he'd gone through a long emotional process to prepare himself for the sale.

Laliberte dismissed any suggestions the Cirque is in financial difficulty, saying it is a profitable venture that sells 11 million tickets a year.

He said the sale -- only approved early Friday morning -- will be good for the Cirque as it aligns with partners that can nearly double its growth by piercing the complex Chinese market and expanding third-party licensing deals and digital media.

Although the new owners have made a commitment to Investment Canada to preserve the Cirque's Montreal headquarters, there's no written guarantee.

But incoming chairman Mitch Garber said TPG understands the company's core value is its Quebec-based creativity.

"It's not only a political statement and a statement of heart, it's a sensible financial reality that we have with the Cirque du Soleil," he told reporters.

Laliberte rejected a recent newspaper cartoon that showed U.S. flags flying over the Cirque's big top. He likened the Cirque to other respected Quebec-based companies like Alimentation Couche-Tard, Molson Coors, Bombardier and Garda that have large U.S. shareholders.

"Why are we so scared we will lose that identity?" he asked. The fact is that with just a eight million people, Quebec companies can only pursue international growth by finding well-financed corporate partners, he said.

"And sorry gang, there is a little more money on the other side of the border than there is here to allow companies like the Cirque or others to grow more solidly."

Laliberte said he was surprised to have lasted so long, having originally foreseen a 10-year run. He began to think about finding a strategic partner in 2006, and thought he found the right match two years later in Dubai World, a large real estate developer that quickly ran into financial difficulties.

The latest sale process originally identified 94 potential partners. After weeding out incompatible potential partners, the list was whittled down to 46. Eight finalists were chosen among 17 that responded with offers.

The sale to the group led by TPG is expected to close in the third quarter.