MONTREAL - Canadian airlines have enjoyed a two-year boom amid consumer hunger for post-pandemic travel. But as that pent-up demand recedes, the country's largest carrier hopes to ramp up ticket sales to corporate customers instead.

Until recently, the travel surge that followed COVID-19 restrictions failed to reach the business world, where pandemic habits of video conferencing and remote work proved tough to shake.

But Air Canada, which reported a first-quarter earnings loss on Thursday - and suffered an eight per cent share price drop - perceives signs of a shift.

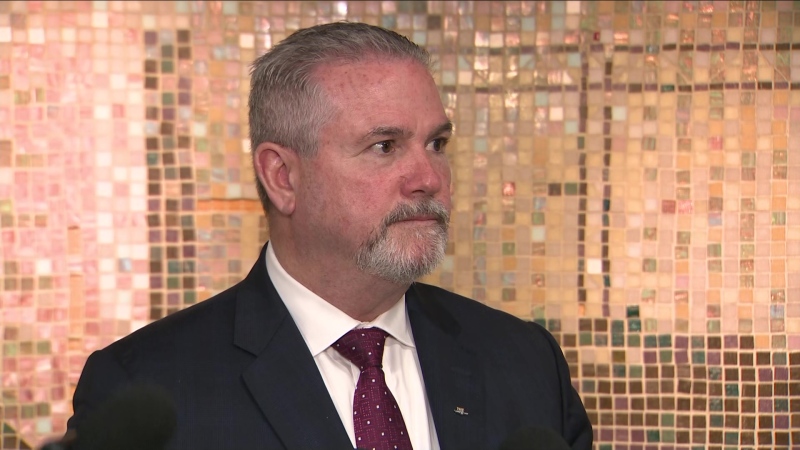

“In Q1 it was relatively stable. We didn't see a big growth, as some of our American peers did,” said Mark Galardo, head of revenue and network planning, referring to business travel.

“But as we look late into the quarter and into Q2, we're starting to see some very encouraging signals on corporate demand - to the tune of almost 10 to 20 per cent greater on a year-over-year basis.”

Air Canada said premium products - business cabin and premium economy fares - accounted for 30 per cent of passenger revenue growth in its first quarter. The tickets yield fatter profit margins than lower-tier seats.

The bump hints at the potential demonstrated by U.S. carriers, which enjoyed a marked rebound in business travel this year.

Delta Air Lines posted a double-digit year-over-year leap in corporate sales in its first quarter. It expects record revenues from business passengers in the second, saying 90 per cent of its corporate clients aim to continue or increase their travel levels this quarter.

United Airlines' chief financial officer said two weeks ago that its business-travel bounceback was “wind in our sails,” and forecast stronger tailwinds to come.

Alaska Airlines raised its 2024 earnings prediction earlier this month on the assumption that corporate income will offset rising fuel costs. More travel spending by technology companies such as Microsoft and Amazon contributed to the increase, the carrier said.

Air Canada saw a similar trend. Executives in the tech and transportation sectors have returned to Canadian skies in greater numbers, “which is a very, very good sign for a rebuild on the corporate demand side,” said Galardo.

“It's a little bit early to spike the ball on that, but we're seeing some very, very strong signals.”

Across the country, spending on business travel is forecast to grow nearly 14 per cent to US$25.9 billion this year, beating the U.S. and global averages, according to a new report from the Global Business Travel Association.

A slice of those sales would be welcome at Air Canada. The company lost $81 million in its first quarter, falling below analysts' expectations even as revenue and capacity ramped up.

Canadians' diminishing appetite for post-pandemic travel made for thinner margins on fares, while a 21 per cent year-over-year rise in wages drove up overall expenses, the airline said.

“As expected, pent-up demand and 'revenge travel' factors are slowing over time,” said Galardo.

“Winter is challenging every year,” added CEO Michael Rousseau, referring to what is traditionally the toughest quarter for North American carriers.

Supply chain problems posed another hurdle. Air Canada is among the airlines facing knock-on effects from the recall of Pratt & Whitney turbofan jet engines for inspection and repair.

“We've got at this point in time six or seven planes sitting on the ground,” said Rousseau. “We are incurring the costs right now.”

The company hopes to recover some of them “in the not-so-distant future,” the chief executive said.

Its stock fell $1.71 or more than eight per cent to close at $18.75 on Thursday.

Not all were troubled by the drop.

“The current valuation for Air Canada continues to reflect what we believe is an overly pessimistic outlook,” said National Bank analyst Cameron Doerksen in a note to investors.

“While there are some market pockets where competition is leading to lower fares (sun destinations notably), we stress that Q1 last year was exceptionally strong from a demand and pricing perspective, so Air Canada is lapping some difficult comparatives.”

The first quarter also accounts for no more than 15 per cent of full-year adjusted earnings, he added, “so we are not overly concerned by a modest miss.”

The Montreal-based company boosted passenger revenues by nearly 11 per cent year over year in the three months ended March 31.

It also reaffirmed plans to bolster capacity by between six per cent and eight per cent and increase adjusted earnings to between $3.7 billion and $4.2 billion this year.

However, the airline still expects to remain below its soaring 2019 capacity levels until 2025, five years after COVID-19 first hammered the travel industry.

“While we worry about the level of capacity growth we are seeing, management noted they are seeing strong bookings for the next few months,” said TD Cowen analyst Helane Becker.

The company continues to negotiate a new contract with its 5,000-plus pilots.

On Thursday, Air Canada reported that it swung to a loss in its first quarter compared to net income of $4 million in the same period a year earlier.

Operating revenue rose seven per cent year over year to $5.23 billion.

On an adjusted basis, the company said it lost 27 cents per diluted share in its latest quarter compared with an adjusted loss of 53 cents per diluted share the year before.

While an improvement, the result fell short of analysts' expectations of an adjusted loss of seven cents per diluted share.

This report by The Canadian Press was first published May 2, 2024.