MONTREAL -- BCE Inc. expects that its new proposal to buy Astral Media will address the federal regulator's concern about the telecom giant dominating the television market.

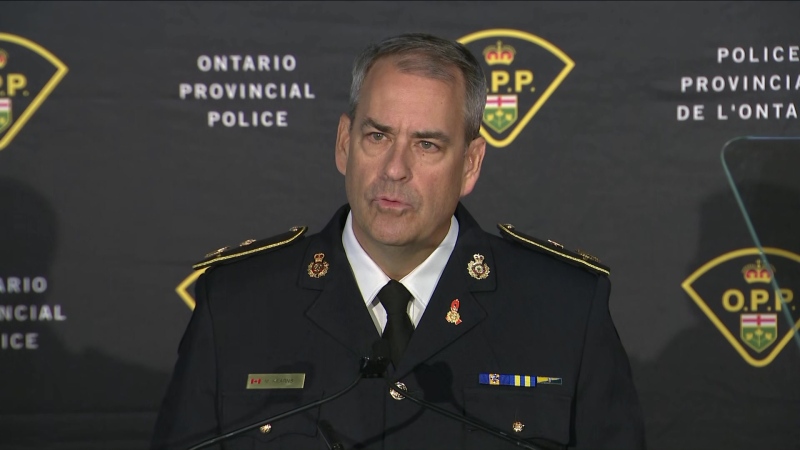

Bell's chief regulatory officer Mirko Bibic wouldn't comment Monday on the possible sale of any radio or TV assets owned by Montreal's Astral to make the deal work. But Bibic said the new $3.38-billion proposal to buy Astral (TSX:ACM.A) will address the CRTC's concern about market dominance.

"The proposal that we filed today will address the issue of viewing shares from the CRTC's perspective," Bibic said from Ottawa.

"It's putting a package together that addresses the mechanical, numerical threshold the way the CRTC calculates it."

However, the companies said they cannot give specifics about the new application until the CRTC makes it public, which it is expected to do in early 2013.

Astral has 25 specialty TV services, including The Movie Network, Family Channel and Disney XD, and 84 radio stations.

Bell, owner of the CTV TV network, has said it wants to put Astral's content on smartphones, tablets, computers and traditional TVs, and to compete with foreign online competitors such as Netflix.

The CRTC killed the deal last month, saying it wasn't in the best interests of Canadians and would have resulted in an unprecedented level of concentration in the Canadian marketplace.

The CRTC said if the multibillion-dollar deal had gone ahead, Bell would have controlled almost 45 per cent of the English TV viewership and almost 35 per cent of the French-language market.

But Bell (TSX:BCE) disagreed. It argued that the combined companies would have an English-language TV market share of 33.5 per cent and the combined companies would have a 24.4 per cent stake in the French-language TV market, both within the rules.

The discrepancy arose because Bell included U.S. competitors in the calculations, while the CRTC did not.

"The reason we filed again is we're confident we've addressed the concerns of the CRTC as we understand them," Bibic said, though he didn't say whether either company would divest assets.

If Astral has to sell some of its broadcast assets to make the deal work, other media and telecom companies are expected to come forward.

Rogers Communications Inc. (TSX:RCI.) could be one of them. Toronto-based Rogers had told the CRTC, when it was weighing the original proposal, that Astral should have to divest its English-language TV assets for the deal to go ahead.

"It's premature to speculate, no details have been released," Rogers spokeswoman Patricia Trott said Monday.

"Like others in the industry, we are watching with interest."

Corus Entertainment (TSX:CJR.B) has also been named as possible buyer for some of the Astral assets. Corus couldn't be reached for comment on Monday.

Bell said its new proposal to buy Astral will also put an emphasis on what Canadian viewers and listeners want on all platforms.

"It's about putting Canadian content front and centre; Canadian artists, musical or otherwise, front and centre," Bibic said.

A multiplatform service with content from Bell and Astral to compete with Netflix will go ahead under the new proposal, Bibic said.

But a French-language all-news channel and expansion of broadband services in northern Canada will no longer be part of the $241 million in "tangible benefits" that BCE would pay if the deal goes ahead, Bibic said.

He wouldn't say if Bell has increased the amount of benefits it would pay, adding at "least 85 per cent of whatever the number is will be directed to onscreen content."

Technology and media analyst Carmi Levy said there will have to be a sale of some of Astral's specialty TV assets.

"There's nothing else it can possibly do to bypass the original objection to the deal," said Levy, an independent analyst based in London, Ont.

But if Bell and Astral have "simply put lipstick on a pig," the deal won't go anywhere, he said.

"The changes will have to be significant and substantive in order to prevent the same kind of mass opposition that they had during the last round of public input."

The deadline for the new proposal is June 1 and Bibic said he expects new hearings before the Canadian Radio-television and Telecommunications Commission.

The companies said in their joint announcement the revised deal is worth $3.38 billion, subject to approval by the CRTC and the Competition Bureau -- the same value as the original deal.

Bell has also asked for a CRTC exception to allow the Montreal station TSN Radio 690 (CKGM) to continue to operate as an English-language sport talk radio channel.

Bell had to counter much public opposition to the last deal before the CRTC hearings, including the chief executives of Cogeco (TSX:CGO) Quebecor Inc. (TSX.QBR.B) and Internet, TV and phone services provider Eastlink publicly lining up against the deal.

This time, Bell has launched a website, canadiansdeservemore.ca, to explain the deal.

Shares in Astral closed up $1.38, or 3.1 per cent, at $45.78, while shares in BCE gained two cents to close at $42.01 on the Toronto Stock Exchange.