CALGARY -- A major Canadian oil company is being acquired by China National Offshore Oil Co. in a US$15-billion deal that, if successful, will be China's largest ever overseas acquisition.

With promises of making Calgary the base of its Western Hemisphere operations, plans to list its shares on the Toronto Stock Exchange, and vows to keep all current Nexen Inc. employees and management, CNOOC says its cash bid for Nexen shows "we are in Canada to invest."

"We intend to be a local company as much as a global one," CNOOC chief executive Li Fanrong told reporters on a conference call Monday.

The friendly deal is still subject to shareholder, regulatory and government approval -- and CNOOC says it reached out to the federal government ahead of Monday's announcement.

The Chinese state-owned company will base its North and Central American operations -- including $8 billion in existing CNOOC assets -- out of Calgary, said Li.

For years leading up to Mondays' announcement, Nexen (TSX:NXY) had been a perennial subject of takeover speculation.

"I'm not sure why it took so long," said Lanny Pendill, an energy analyst with Edward Jones in St. Louis.

"I think the fact that the sector has really been beaten down with all of the macro concerns about economic growth and we've seen oil prices slip back a little here, from CNOOC's perspective it was probably now or never."

Nexen has faced numerous challenges over the past few years, including the troubled launch of its Long Lake oilsands project in northern Alberta in late 2008. The project has yet to come close to its design capacity of 72,000 barrels of bitumen per day due to a number of operational glitches, though performance has been improving in recent months.

Last week, the company reported that second-quarter profits tumbled nearly 57 per cent as it took a charge on an unsuccessful well in the Gulf of Mexico. Late last year it was shouldered out of a major project in Yemen amid political strife in the Middle Eastern country.

CNOOC already had a 35 per cent stake in Long Lake after it took over Nexen's erstwhile partner Opti Canada Ltd. for $2.1 billion last year. The two companies also work together in the Gulf of Mexico.

So news that CNOOC is taking over Nexen in its entirety did not come out of the blue, said Wenran Jiang, a senior fellow at the Asia Pacific Foundation of Canada.

The $15.1-billion Nexen deal stands in contrast to CNOOC's $18.5-billion bid for U.S. energy company Unocal in 2005, which was ultimately nixed for political reasons.

"It was a surprise move and eventually it was rejected," said Jiang, noting Beijing-Ottawa relations have been warming in recent years and both the federal and Alberta governments have shown an openness to foreign investment.

"But this one has been incremental and has been, of course, in an environment that's most likely to go through."

Jiang said getting approval from the Canadian government may not the biggest challenge that lies ahead for CNOOC.

"A lot of people are focusing on the deal itself, which is large. It's noticeable. But I want to point out that the challenge is not really about the takeover approval process," he said.

"The challenge may well lay ahead on what's afterwards, what happens after the takeover."

Nexen's current management and staff are accustomed to working independently, but now they'll have to mesh with new Chinese owners.

"There will be challenging issues on management styles, culture differences and a range of other things," said Jiang.

But there are definite benefits, too -- not the least of which is CNOOC's deep pockets.

"CNOOC brings in a big amount of capital and it brings in reassurance that the company is stable, the finances are strong."

The transaction values Nexen at $27.50 per share -- a 66 per cent premium over the 20-day weighed volume average of Nexen shares, and a 61 per cent premium on the closing price of its shares on Friday at the New York Stock Exchange.

On the Toronto Stock Exchange, shares of Nexen rose more than 52 per cent, or $9.06, to $26.35 in afternoon trading.

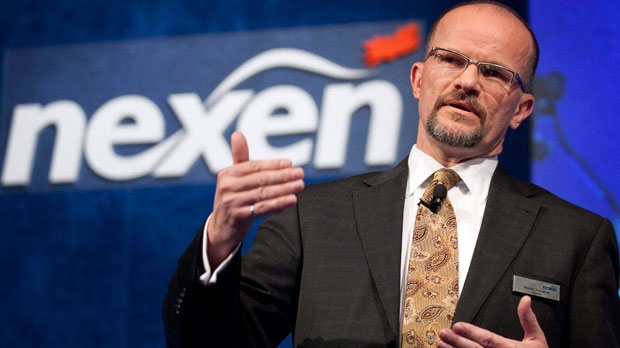

"First and foremost this transaction delivers significant and immediate value to Nexen's shareholders," said Kevin Reinhart, who has been serving as Nexen's interim CEO since Marvin Romanow's abrupt exit in January.

"For our employees, we believe this opens the door to exciting new opportunities for them as part of a larger, financially stronger global organization," Reinhart, who had been Nexen's chief financial officer, told reporters on a conference call.

"CNOOC Ltd. intends to increase its investment in our existing assets and they expect our people to help expand their influence internationally."

Reinhart said he'll have to talk to Li about what role, if any, he'll have in the company after the deal closes.

Reinhart declined to comment on how Ottawa reacted when it was given the heads-up the deal was coming.

"We will work together to file the necessary applications and to work with the various governments to ensure they have all the information they need to make the right decision."

The Nexen deal will face a review by both the federal industry minister -- who must determine whether the deal is a net benefit to Canada as a whole-- as well as by the federal Competition Bureau.

As part of the transaction, CNOOC said it plans to list its shares on the TSX.

The transaction still requires two-thirds of Nexen shareholders to approve the agreement at a special meeting to be held by Sept. 21. Preferred shareholders would receive $26 in cash, plus accrued dividends.

Pendill, the Edward Jones analyst, said the price CNOOC is paying for Nexen is fair, given the economic climate and the challenges the company has faced.

"We're recommending our investors sell the shares, take the proceeds and look at alternative names in the sector," he said, citing Suncor Energy Inc. (TSX:SU) and Canadian Natural Resources Ltd. (TSX:CNQ) as top picks.

If the deal isn't completed, CNOOC is subject to a termination fee of US$425 million.

The Chinese company has made several other investments in Canadian companies over the past seven years, including buying stakes in MEG Energy Inc. and a 60-per cent investment in Northern Cross (Yukon) Ltd.