As housing prices across the country continue to be unaffordable for many would-be homebuyers, an increasing number of Canadians are opting to purchase property with family or friends, according to a recent survey from Royal LePage.

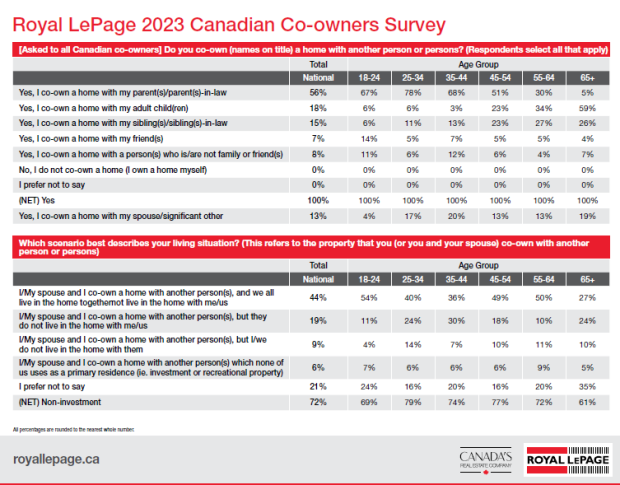

The survey, conducted by Leger, found that six per cent of all Canadian homeowners co-own their property with another party other than their spouse or partner, and of that group, 76 per cent say that affordability was a major motivating factor in their decision to co-own.

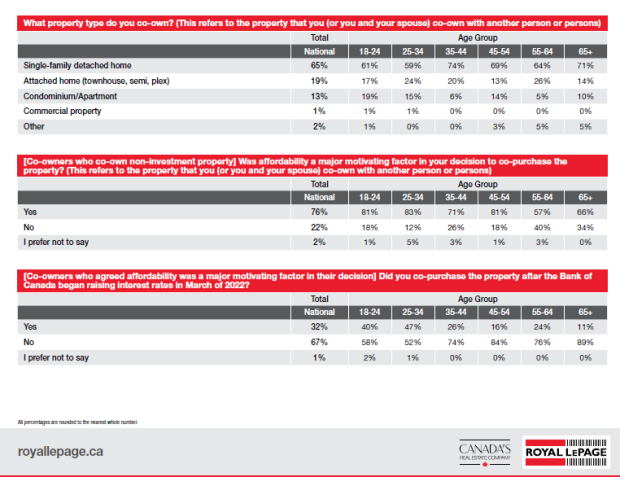

That number rises to 83 per cent for co-owners between the ages of 25 and 34, according to the survey, which also found that nearly one-third of respondents who decided to co-purchase for affordability reasons did so after the Bank of Canada began raising interest rates in March of 2022.

Of the six per cent of Canadian homeowners who co-own a property, the vast majority – 89 per cent – co-own with family members, while seven per cent co-own with friends, according to the survey.

“Different generations of families living under one roof is not a new phenomenon, but has been growing in popularity in recent years. Census data shows that multigenerational households are now the fastest growing household type in Canada,” said Karen Yolevski, COO of Royal LePage, in a press release.

“Households group together for many reasons, including communal care for elderly parents, help raising children, cultural preferences or simply to be together. However, the decision to live together, including co-owning a home, is a decision increasingly made for financial reasons.”

When it comes to the logistics of sharing a home with another person, the survey found that 44 per cent of co-owners live with their fellow co-owner, while 28 per cent do not.

Six per cent of respondents said that neither they nor their co-owners use the home as a primary residence, but rather as an investment or a seasonal or recreational property like a cottage.

“The COVID-19 pandemic forced some Canadians to reconsider their living situation, with many choosing to share living space with friends or family in a time of isolation,” the release read. “Now, in an era where social distancing restrictions have ceased, a number of Canadians continue to choose cohabitation to address their housing needs.”

Another recent Royal LePage survey found that more than a quarter of real estate professionals surveyed across the country say they’ve seen an increase in homebuyers looking to purchase property with another person compared to pre-pandemic times.

The same survey found that a third of Canadian real estate professionals have seen increased interest in co-ownership since borrowing rates began to rise in the spring of last year.

“In a market beset by reduced home supply, escalating prices, tightened mortgage qualification requirements, and the highest borrowing rates in more than two decades, many buyers are having difficulties securing the property that they want. Some Canadians are using co-ownership as a way of boosting their borrowing capacity or lowering their monthly mortgage costs, helping them achieve their goal of home ownership,” Yolevski continued in the release.

“By dividing the cost of a home between more people, Canadians can not only get their foot on the property ladder more easily, but also expand their home search to more desirable locations or larger properties that may not have been accessible with their budget alone.”

Of all co-owners surveyed by Royal LePage, 65 per cent say that they co-own a single-family detached home, 19 per cent say they share an attached home, such as a townhouse or semi-detached property, and 13 per cent say they share a condominium/apartment.

The survey also found that nearly half of all co-owners who live with their fellow co-owner decided to co-purchase their home because they otherwise wouldn’t have been able to afford it.

Thirty-eight per cent said that by co-owning, they were able to afford a larger property, or a property in a more desirable neighbourhood, while 30 per cent said that they co-purchased a home because they needed family support with childcare or taking care of elderly relatives.

Despite the recent rise in popularity of co-ownership, Yolevski says in the release that purchasing a home with someone else is a more complicated process than people may realize.

“Opting to co-own with friends or family is not as simple as signing a piece of paper next to someone else’s name – co-owning a home often comes with meaningful lifestyle changes, and requires in-depth conversations over financial, legal and personal obligations,” she said.

“Regardless of whether you live in the home with your fellow co-owners or not, the responsibilities of owning a home with other people are shared, but so are the benefits.”