OTTAWA -- The federal Liberals say they can add almost $146.5 billion in new government spending over the next four years, and still bring the budget back to balance with a surplus of about $1 billion by the end of a four-year mandate.

To get there, they say, a Liberal government would seek out billions in savings from eliminating a number of tax breaks, cutting back on government spending and cracking down on tax evasion.

The party's most prominent financial lieutenants released the full costing of the Liberal campaign platform Saturday, outlining the billions in new spending and revenues that would be in store for the next four years should a Liberal government be elected on Oct. 19.

They didn't go as far as to outline the tax credits and benefits that would go should they win, but they did hint that it would mean the end of boutique tax breaks that help Canada's top one per cent of earners -- in particular a stock-options tax break for CEOs.

Nothing, however, is off the table as the Liberals scour the financial tables for a combined $6.5 billion in savings over four years from government programs and tax breaks.

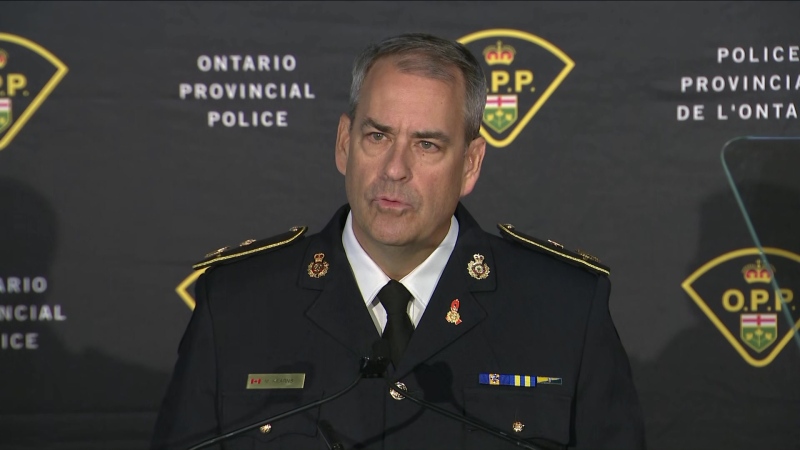

"We are confident in our plan," said Liberal candidate John McCallum, a former finance critic and Royal Bank chief economist. The plan is based on the latest available figures from the parliamentary budget officer and the bank of Canada, he added, but also allows for a number of economic variables, such as low oil prices and a low Canadian dollar.

"There are many countervailing forces in both directions that may make such forecasts higher or lower, and we would account for that," McCallum said. "We have already put in prudence that could offset a number of factors that could arise."

The promise of a balanced budget could easily be jeopardized if any of those measures should fail to bring in the revenue the Liberals are banking on -- and there are still more spending promises to come.

Liberal Leader Justin Trudeau still has to announce about $7.5 billion in spending promises for the next four years that could touch on what the party plans to do for health care spending and climate change.

The NDP, meanwhile, dismissed the entire plan as based on little but "austerity, unfunded and broken promises" and "bad math."

Focusing in on the Liberal pledge to hunt down savings in government spending, NDP candidate Andrew Thomson -- a former Saskatchewan finance minister -- said the Liberal plan would lead to "deep cuts in the services that Canadians rely on."

The Conservatives seized on the $6.5 billion in savings the plan requires, warning of potential tax hikes that should make Canadians "hold on to their wallets." Conservative candidate Pierre Poilievre said the Liberals couldn't "pull $6.5 billion out of thin air," and that they would have to find the money through cuts or tax increases.

The plan calls for a deficit of just under $10 billion in the next two fiscal years, the result of a plan to add more than $33 billion in the next fiscal year and $36 billion the year after in new spending for infrastructure projects and a new monthly child benefit.

The deficit drops to $5.7 billion in year three, with the books creeping into balance by the fourth year.

The Liberals are hoping that infrastructure spending in particular helps prod economic growth in Canada to help increase tax revenues and pad government coffers just in time for their promised balanced budget.

Veteran Saskatchewan Liberal Ralph Goodale, a former finance minister under Paul Martin, said it's important to note that the plan -- while including "manageable, modest deficits" -- includes a constantly declining debt ratio and is designed to foster economic growth.

"Our major policy thrust is investing in growth," Goodale said. "That's the fundamental thing that is so lacking in the Canadian economy today."

The party, however, has not counted any of the extra revenues from those investments -- known as a multiplier effect -- into their budget calculations. Nor has the party counted any tax revenue that the government could accrue from the legalization of marijuana.

The plan also exhausts an annual contingency fund of about $3 billion that the federal government keeps on the books for unforeseen circumstances.

The Liberal plan wouldn't bring the contingency back into play until the fourth year of its mandate, at which point it would start at $1 billion -- the amount the party is budgeting for its surplus.

The Liberals also say they would also expand the mandate of the parliamentary budget officer to allow it to check the costing of any promises parties make during federal elections.