It’s getting more expensive to drive a car in Ontario and rates in at least one city have jumped by nearly 40 per cent since 2021, a new report says.

Rising inflation, an ongoing shortage of vehicles and their parts, as well as an increase in car thefts are behind the hike, according Ratesdotca.

Those factors, paired with the fact more drivers are hitting the road as the COVID-19 pandemic appears to be in the rear view, show that auto insurance premiums across Ontario have increased by 12 per cent in the last two years.

In December of 2021, that last time Ratesdotca surveyed the province, the average estimated auto insurance premium was $1,555 based on sample quotes for a 35-year-old male driver with a clean driving record who drives a four-door sedan.

Now, the company estimates the average premium to be $1,744.

While that may seem like a lot, it’s cheaper than what auto insurance will cost you in Brampton.

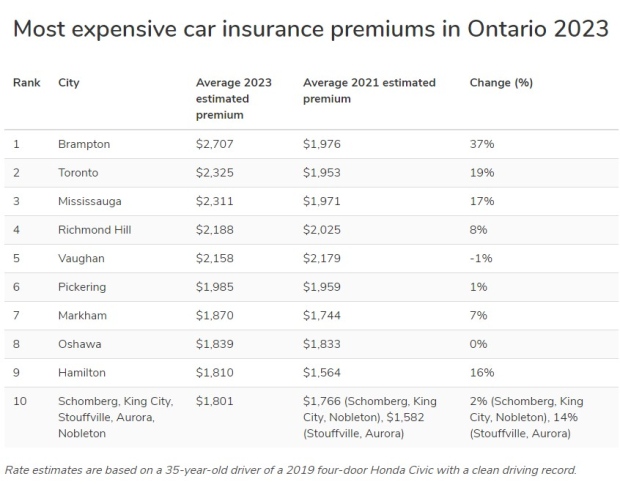

That city tops the report’s top 10 list for most expensive cities in Ontario for auto insurance, where driving will cost you an estimated $2,707. In 2021, rates in Brampton were $1,976.

Drivers in Toronto don’t fare much better. Rates in Ontario’s biggest city are an estimated $2,325 in 2023 – a 19 per cent jump from $1,953.

Mississauga holds the unenviable third spot at $2,311, which marks a 17 per cent hike from $1,971.

A full list of all the Ontario cities covered in the report can be found here.

EXPECT A BUMPY RIDE IN 2023: REPORT

Rates are expected to raise even higher, a Ratesdotca insurance expert said, as car coverage companies look to catch up with inflation.

"Just because they were allowed to increase [their rates] doesn't mean it's enough to take care of their losses from the last few years. There's some fine-tuning to come,” Daniel Ivans said in the report.

Late last year, the rising rate of inflation pushed a number of insurers in Ontario to request permission from the provincial regulator to increase rates.

The Financial Services Regulatory Authority (FSRA) has approved 22 increase requests since the beginning of this year, the company said, with the average change per insurer sitting at 6.5 per cent.