Activity in Toronto’s housing market appears to be levelling off following a sharp decline over the spring that saw home prices drop significantly.

But a new national report from RBC suggests that property values in the city and across Canada are still falling, albeit at a slower pace.

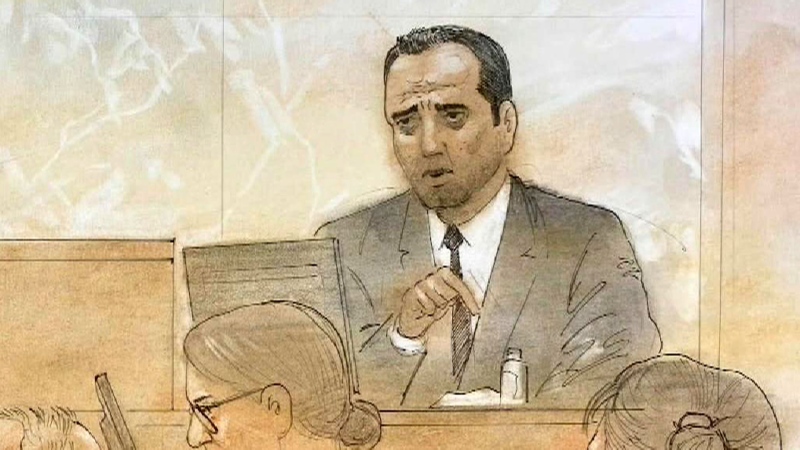

“Nationwide, our view is that that benchmark prices will fall 14 per cent from peak to trough and probably a bit more in Ontario,” RBC Economist and report author Robert Hogue told CTV News Toronto in an interview.

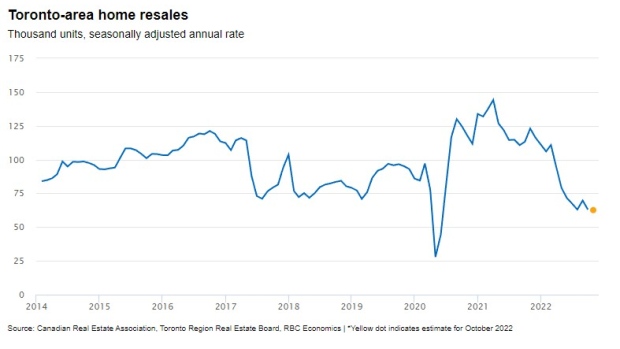

The data shows that activity in the Toronto area real estate market was generally flat from July to September with 63,000 to 69,700 resales taking place during that time. The report’s preliminary estimate for the month of October sits at 62,600.

Compared to the February peak that saw 110,800 resales, Hogue said Canada’s rising interest rates have “clearly” turned down the temperature on both demand and supply and the “excesses” of an overheated Toronto market are burning off.

“We're seeing that in prices that are coming down quite substantially, and will continue to do so,” Hogue said.

The Bank of Canada has raised interest rates six times already this year and is expected to announce another hike in December in an effort to fight inflation.

The Bank of Canada has raised interest rates six times already this year and is expected to announce another hike in December in an effort to fight inflation.

Since the first hike in March, the MLS’ Home Price Index (HMI), which Hogue describes as a “pure measure of a property’s value,” for the Toronto area has fallen 18 per cent

That means a home purchased in February is now worth roughly $230,000 less on average.

But when exactly will prices bottom out and could that be the time to get into the market as a first-time home buyer?

According to Hogue, spring 2023 will be time to watch as it could “open some doors” to buyers who have been waiting on the sidelines.

“At that point, we would expect to see affordability start to improve given, hopefully, by then, interest rates will have reached their peak and the big declines in prices will start to flow through better affordability,” he said.

“Downward pressure on prices will persist for the time being [in the Greater Toronto Area]. And, in our view, the way to alleviate, at least partly some of the affordability problem, is prices have to fall, so we have prices continuing to fall until the spring.”

At the same time, and despite interest rates being the highest they’ve been in more than a decade, Hogue’s report suggests the market hasn’t witnessed what he described as a “distressed selling wave.”

"Delinquency rates remain exceptionally low. And for sure, there is some tension building with higher rates, especially for those with variable mortgages, based on tremendous increase in the interest rates.

“This could potentially lead to trouble for some, but at this point, we're not seeing this,” he said.

Hogue went on to say the federal government’s stress test—a tool used to cool down an overheated housing market—will help prevent a “critical mass” of homeowners selling off.

The newest iteration of the stress test went into effect in June of 2021 and sees uninsured mortgages set at either the mortgage contract rate plus two per cent or 5.25 per cent (whichever is greater) in order to make sure a homeowner can afford to pay off their house.