Shopify Inc.'s president says the company is focused on tamping down on operating expenses as it strives to get back to profitability.

“If you look over the seven years since (our) IPO, five of those years, we've been profitable. We plan on becoming profitable again,” Harley Finkelstein told a conference call to discuss the company's latest financial results.

“We said this year is an investment year, but this is a company that thinks deeply about managing expenses, growing revenue, and ultimately, this is a company that likes to be profitable, and we will get back there.”

Finkelstein's remarks come months after Shopify laid off 10 per cent or roughly 1,000 of its workers and admitted it misjudged the growth of e-commerce.

The Ottawa-based company bet the amount of shopping people did online would leap ahead by five or 10 years from pre-pandemic predictions, but as COVID-19 measures were lifted, people instead reverted back to pre-health crisis purchasing habits.

The company, which keeps its books in U.S. dollars, reported Thursday a net loss of US$158.4 million or 12 cents per diluted share in its latest quarter compared with a net profit of nearly US$1.15 billion or 90 cents per diluted a year ago.

The net loss for the quarter ended Sept. 30 included a US$171.9-million net gain on its equity and other investments, while its results a year ago included a US$1.3-billion net unrealized gain from equity and other investments.

Revenue in the quarter totalled nearly US$1.37 billion, up from US$1.12 billion in the same quarter last year.

Though Shopify's share price surged in mid-morning trading by almost 17 per cent to $46.16 on the news, the company isn't expecting to soon stem its losses.

It expects to end the year with an adjusted operating loss, outgoing chief financial officer Amy Shapero said.

On an adjusted basis, Shopify had a net loss of US$30.0 million or two cents per diluted share in its third quarter, compared with adjusted net income of US$102.8 million or eight cents per diluted share for the third quarter of 2021.

Economic headwinds also loom large. Retailers are grappling with higher costs for materials and shipping and supply chain challenges from last year remain.

Meanwhile, consumers are finding everything costs more, weighing on their shipping patterns.

“Higher inflation and rising interest rates will continue to negatively affect the consumers' purchasing power of discretionary goods and services,” Shapero said.

But she remains confident Shopify can weather such conditions, in part because the company's revenue increased and its tamped down on expenses.

The company reported subscription revenue rose to US$376.3 million compared with US$336.2 million a year ago, while merchant solutions revenue amounted to US$989.9 million, up from US$787.5 million.

“The discipline and rigour that we continue to apply across the organization, beginning with software development to ultimately the commercialization of our solutions, will position us well for long-term growth and improving profitability when exiting this macro cycle,” she said.

Shapero and Finkelstein dedicated much of the call to discussing a series of investments the company is focusing on to head off economic challenges and find profitability.

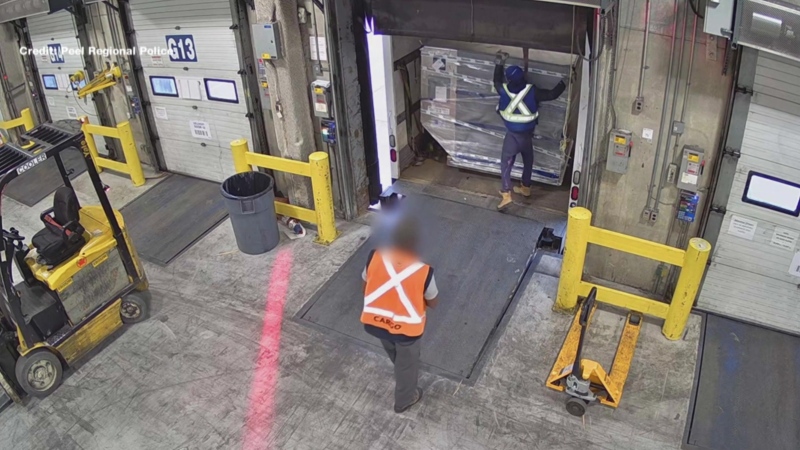

The biggest is its fulfilment network, which helps merchants ship goods to consumers and is seen as a way Shopify is upping the ante in its battle with Amazon.com Inc.

Finkelstein said the company has become more intentional about what kinds of products it wants to handle. He noted the company is not interested in shipping perishables any time soon, but sees apparel, consumer-packaged goods and items smaller than a microwave as being the goal.

The financial report was the final one for Shapero who is stepping down. The company has said Jeff Hoffmeister will take over as chief financial officer following Shapero's departure.

The company also recently named Kaz Nejatian chief operating officer with new chief revenue officer Bobby Morrison and chief growth officer Luc Levesque reporting to him.

This report by The Canadian Press was first published Oct. 27, 2022.