TORONTO -- Three former Nortel executives accused of defrauding millions from the now insolvent tech firm knowingly participated in a "cookie-jar accounting" scheme, the Crown alleged in closing submissions Thursday.

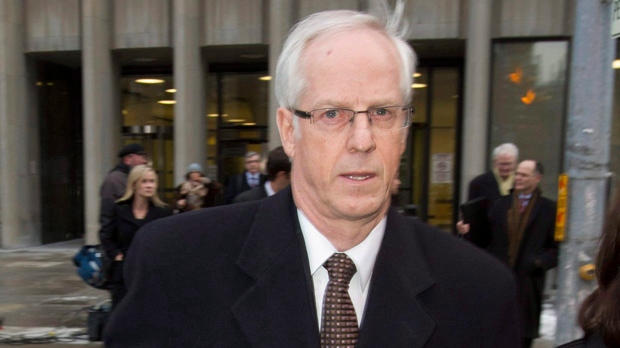

Ex-CEO Frank Dunn, ex-CFO Douglas Beatty and ex-controller Michael Gollogly each face two counts of fraud for allegedly manipulating the Ottawa company's financial statements.

All three have pleaded not guilty.

Crown attorney Robert Hubbard told Ontario Superior Court Justice Frank Marrocco that these top players "told lies" about the company's finances to keep investors in the dark. The motivation, court heard, was $12.8 million in bonus payments -- $9.7 million in 2003 and $3.1 million in 2001.

These lies, the Crown argued, involved the three executives, two of whom are chartered accountants, manipulating the financial books to show an inaccurate return of profitability. That, in turn, would trigger large bonuses for them even though the company was struggling financially.

These deliberate efforts to conceal the "financial reality" of Nortel from the public is enough to amount to fraud, Hubbard told the court.

"(The accused) were massaging the balance sheets for later," he said.

"It is only by maintaining a bloated balance sheet that the accused could engage in cookie-jar accounting by using excess accruals to supplement earnings."

During the trial, the Crown argued that the company encouraged a culture of "cookie-jar accounting," in which hundreds of millions of dollars worth of fraudulent transactions created reserves that were set aside then used to shore up future quarterly results.

Hubbard argued that the Crown does not need to prove that the men explicitly directed their employees, or even external auditors from Deloitte & Touche who were brought to examine the company's finances.

It only needs to show evidence that the accused men had created an environment where the accountants had no choice but to fudge the numbers so the company's unrealistic financial roadmaps and outlooks could be met, court heard.

"Stretch targets were given and the only way to meet them, with the financial reality of Nortel... the only way to meet them was through excess accruals," he said.

The Crown also charged that the executives dismissed concerns raised by the auditors about the accuracy of the financial statements, and purposely kept the company's financial targets from them.

It's alleged that Dunn, Beatty and Gollogly released only $80 million of Nortel's $189 million in reserves during one quarter so it appeared the company was turning a profit, even though it was in the red.

All three benefited from cash and stock bonuses that were triggered when it looked like the company's internal targets were being met during their quarterly reports, court heard.

The defence maintains there is no proof that the men asked anyone to create false financial statements or orchestrated a so-called large-scale conspiracy among dozens of employees. It also argued that no fraud could have taken place because the release of the accruals had been approved by outside auditors.

The defence will present their closing submissions next week.

Dunn, Beatty and Gollogly were fired from Nortel over the fraud allegations in 2004.

The telecom company declared bankruptcy in Canada and the U.S. in early 2009.

Since then, the company had sold off US$3.2-billion of operating units -- bringing the total value of the company's sell off to US$7.7-billion in one of the largest asset sales in Canadian history.

At its height, Nortel employed 90,000 people worldwide and was worth nearly $300 billion.

Closing arguments by the Crown were expected to continue into Friday.