MONTREAL - Desjardins Group said Thursday a former employee shared the personal information of more than 2.9 million of its members with individuals outside of the organization in a “malevolent” act.

The Quebec-based financial institution said the breach, first detected in December, affects 2.7 million individual members and 173,000 business members.

It said the situation is the result of unauthorized and illegal use of its internal data by an employee who has since been fired. Desjardins didn't reveal the employee's identity.

No charges have been laid. Laval police said a male suspect was detained, but is no longer in custody.

Desjardins noted the incident, which affected more than 40 per cent of its members, was not the result of a cyberattack and that its computer systems were not breached from the outside.

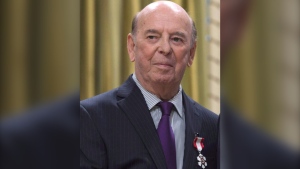

Desjardins Group chief executive Guy Cormier said the lone suspect “acted illegally, betraying the confidence of Desjardins.”

“Honestly, this situation right now is totally unacceptable,” Cormier told reporters, calling the breach “malevolent.”

“We regret this situation and are making every effort to ensure that it doesn't happen again.”

Individual members of the Desjardins financial co-operative may have had several pieces of information released, including name, date of birth, social insurance number, address, phone number, email address and banking habits.

Passwords, security questions and personal identification numbers were not compromised, the organization said.

Business members had information such as their business name, addresses, telephone numbers and owner names exposed.

Desjardins said it is working with police and has implemented additional security measures.

It had filed a complaint with police in Laval, Que., in December after detecting an “irregular situation,” Cormier said. Police told executives in late May that some members had been affected, and confirmed on June 14 that a much larger pool was impacted.

As a precaution, Desjardins said it's also offering to pay for a credit monitoring plan and identity theft insurance for 12 months for affected members - a typical mady by companies that have suffered a major security breach.

Customers affected financially by the breach will be reimbursed, executives said, but declined to put a number on the potential cost to the organization.

“We're talking potentially about fraud. But we cannot answer. It's connected to the investigation that is underway by the police authority,” said operations chief Denis Berthiaume.

He added the organization has not seen an uptick in fraud incidents.

Police declined to offer a possible motive for the breach, noting the investigation is ongoing.

“It's shocking news, because it's a high volume,” said Mourad Debbabi, research chair in cybersecurity at Concordia University. “That's sensitive information. You can do a lot with that.

“When you collect sensitive information, personal information...you have to put in place storage protocols and handling protocols,” Debbabi told The Canadian Press.

The security breach is among the biggest in Canada to come about internally, rather than via external cyberattacks, in recent years.

The Bank of Montreal and the Canadian Imperial Bank of Commerce both suffered data breaches last May. Equifax announced in 2017 that a massive data breach compromised the personal information and credit card details of 143 million Americans and 100,000 Canadians.

In August, some 20,000 Air Canada customers learned their personal data may have been compromised following a breach in the airline's mobile app.

In the past three years, millions of consumers have been affected by hacks against a panoply of companies including British Airways, Uber, Deloitte, Ashley Madison and Walmart.

Companies in this story: (TSX:BMO, TSX:CM, TSX:AC)