The number of complaints over the city’s Vacant Home Tax has ballooned to more than 60,000 after Toronto homeowners who missed the declaration deadline were told they owe thousands of dollars for leaving their properties vacant.

Several Toronto residents told CP24 on Thursday that they recently received a huge tax bill from the City of Toronto for “vacant” properties that they say are actually occupied.

The city’s Vacant Home Tax charges owners who leave their properties vacant for more than six months in a calendar year. For 2023, the taxation rate is one per cent, meaning that the tax for a property valued at $1 million is $10,000.

The deadline for homeowners to declare the occupancy status of their residence was initially set for Feb. 29 but later extended to March 15.

Two women who spoke to CP24.com said they made the declaration when the program was initially rolled out in 2022 but were unaware that they were required to do so each year.

“I’m just furious, and I’m upset, and distressed at the same time,” Riverdale resident Sophie Lem told CP24.com on Thursday after receiving a bill from the city for more than $12,000. “I don’t know what to do.”

In response to the influx of complaints from Toronto residents, Mayor Olivia Chow apologized for the rollout on Thursday, vowing to “clean up the mess.”

"By the time I arrived here, the system was already set… It is not acceptable the way we rolled out this program. It is very new,” Chow told reporters at an unrelated news conference on Thursday.

In a letter released Friday, Chow and Budget Chief Shelley Carroll said city staff have “moved quickly” to put measures in place to reverse over 62,500 Vacant Home Tax charges on Friday morning.

The measures include doubling the number of staff available to support in-person inquiries and extending “in-person support” at city hall and civic centres until at least April 12. The city is also expediting mailouts to impacted property owners to inform them of how to appeal the charge. The city is also updating the Vacant Home Tax website to include information in multiple languages, the letter said.

Many city councillors have expressed frustration with the rollout of the Vacant Home Tax in recent days after receiving complaints from constituents who received unexpected tax bills.

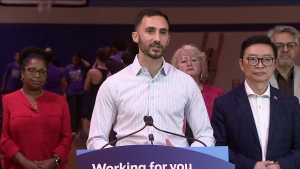

Ward 12 Coun. Josh Matlow told CP24 Thursday that while the Vacant Home Tax is a “useful tool,” the implementation was not successful.

“The Vacant Home Tax is being used by cities as a tool to identify where there are investment properties that are just sitting around, sitting vacant that really should be used as homes in the midst of a housing affordability crisis,” he said.

“This is just a demonstration of an idea that had merit but has not been implemented well.”

Matlow urged residents in this situation not to pay the bill while the city works to resolve the issue.

“You are going to receive an updated notice to inform you about the next steps,” he said Thursday. “I do know that they mayor and city staff are working this out because there is a recognition that this is not done well.”

City Council Speaker Frances Nunziata called the situation a “failure in communication on the part of the city.”

"The City’s outreach efforts failed to effectively reach vulnerable populations such as seniors and those with limited English proficiency, resulting in undue financial burdens and emotional distress among affected homeowners,” she wrote in a statement released Thursday.

“With the commencement of tax bill mailouts on April 2, my office has been inundated with pleas for assistance from distressed residents facing unexpected tax liabilities.”

City spokesperson Russell Baker said the Budget Chief and Mayor will be seeking approval from council to waive the $21.24 late fee for homeowners who missed the deadline.