TORONTO -- One of Canada's largest pension funds is planning a $3-billion-plus development in downtown Toronto, but the project appears to hinge on approval for a casino -- an issue that has generated controversy in the city.

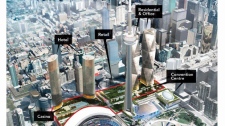

The site of the proposed development by Oxford Properties Group, the real estate arm of OMERS pension fund, is on the south side of Front Street, bounded by Simcoe Street and Blue Jays Way, currently the home of the Metro Toronto Convention Centre.

The development, to be called Oxford Place, includes a revitalized and expanded convention centre, significant new retail, office and residential space, 4,000 new sub-grade parking stalls and an integrated casino and hotel complex.

The casino would be funded, built and operated by the casino operator selected by the province of Ontario.

"Although the casino itself represents less than 10 per cent of the project's area, it is a necessary and essential catalyst for the entire development and is a use that will be complementary to Toronto's core," Michael Kitt, Oxford's executive vice-president, Canada, said in a statement.

Municipal officials in Toronto are seeking approval for a gaming facility in the city and Oxford is "committed to working with the city and other stakeholders as they move forward with their process."

"If the decision is made to have a casino in the City of Toronto, Oxford believes it can provide the best location and the ideal solution for all stakeholders," added Oxford president and CEO Blake Hutcheson.

Ontario Lottery and Gaming has said it wants a downtown or waterfront site for a new Toronto casino, but some city councillors are opposed to having a casino.

The Ontario government wants a motion approved by council stating the city would be a willing host, and has said it will not force any community to take a casino if it doesn't want one.

On Friday, Ontario Opposition Leader Tim Hudak renewed his call for community-based referendums on the issue.

"Our position on the Toronto casino is very simple: any community that wants to have a casino should have a referendum," the Conservative leader said.

"Let the people decide."

A Conservative private members' bill to require such referendums passed second reading, but is stuck in legislative limbo because there are no committees to give it further study.

OLG chairman Paul Godfrey has said the agency would need an answer by the beginning of next year on the OLG's "gaming entertainment centre" proposal, adding a project, if approved, would go forward with advice from the community and city hall.

Oxford says the development, to be fully funded by the private sector, would be one of the largest urban redevelopment projects in North America.

A new 5.5-acre urban park connecting the core to the waterfront is contemplated over the existing rail corridor.

"Oxford Place is a well-conceived private sector solution that requires no public infrastructure or other funding and drives significant community benefits for area residents, visitors, corporate tenants, taxpayers and the broader Toronto community," Hutcheson said.

The project, he added, draws on Oxford's development expertise "demonstrated by our large scale mixed-use projects in New York and London."

The proposed location of the casino and hotel, at the western edge of the project, allows for phased construction to create new convention centre space prior to the demolition of the existing area.

The expanded convention centre would result in over 22 acres of contiguous exhibit space.

Total area of the project would cover 11 acres, including a 1.1-million-square-foot convention centre, 2.5 million square fee of office space, one million square feet of retail space, some 600,000 square feet of residential space, 1.7 million square feet of hotel and amenity space and a 450,000-square foot casino.

Oxford Properties Group is a global platform for real estate investment, development and management, with over 1,400 employees and more than $20 billion of real assets that it manages for itself and on behalf of its co-owners and investment partners.

OMERS, the Ontario Municipal Employees Retirement System, is one of Canada's largest pension funds with over $55 billion in net assets, providing pension administration to more than 420,000 members, about one in every 20 employees working in Ontario.