TORONTO -- Stock markets will be under pressure this week as traders focus on upcoming moves from the U.S. Federal Reserve and troubles brewing in the retail sector.

Toronto's S&P/TSX composite index was higher last week as commodity prices elevated amid uncertainty about what the U.S. economic future holds. The trend will likely continue this week, if the TSX can overcome negative sentiment stateside.

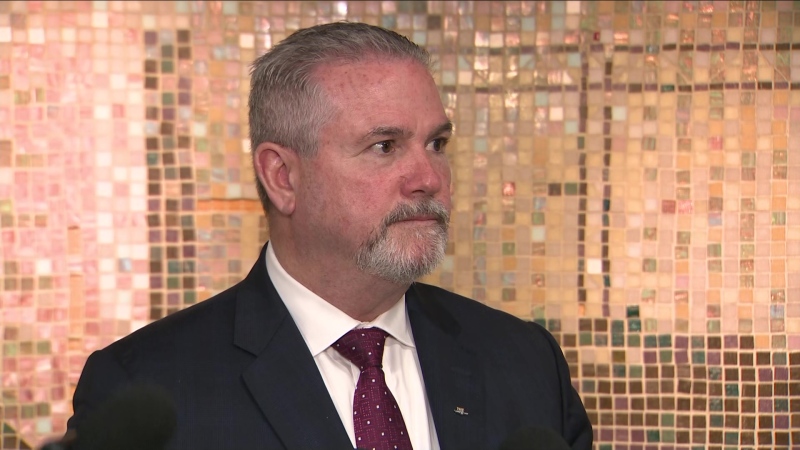

"A lot of people are pausing," said John O'Connell, chairman and CEO of Davis Rea.

"You're at one of those points in time where people begin to reassess positions and probably do a little bit of trimming."

Bonds yields have recently been soaring, with the 10-year U.S. Treasury note touching multi-year highs near 2.8 per cent.

And key commodity prices are rising, with oil getting a boost partly on supply concerns from the unrest in Egypt. Though not an oil exporter, the country controls the Suez canal that links the Mediterranean Sea and Red Sea, giving it a crucial role in maintaining global energy supplies.

Gold prices have also been up as traders moved to the perceived safe-haven of the precious metal. And copper is on a tear, rising six per cent since the start of August.

"All of the things that were tailwinds before are sort of turning into headwinds," O'Connell said.

On Wednesday, minutes of the July meeting of the Federal Open Market Committee will be released, possibly providing clues as to when the Federal Reserve plans to begin winding down its massive bond-buying program.

It's widely expected that asset purchases from the Fed will slow next month, though nothing has been made official yet.

Adding pressure to the economic outlook for the rest of the year are U.S. retailers, who last week delivered a dismal earnings results and reduced expectations.

Nordstrom Inc. was the latest to cut its full-year sales outlook, matching similar moves earlier by both Wal-Mart Stores and Macy's Inc. This week, more U.S. retailers will deliver their latest results and expectations, including J.C. Penney, Target, the Gap, Home Depot, Best Buy, Staples and Sears.

The retail sector is a closely-watched part of the U.S. economy as consumer spending makes up roughly 70 per cent of economic activity.

In Canada, retail sales will likely show a drop of 0.4 per cent in June when statistics are released on Thursday, according to consensus expectations compiled by the Bank of Montreal (TSX:BMO). The decline is expected to be entirely from the floods in southern Alberta.

The consumer price index for July, scheduled for release on Friday, is expected to show inflation rose 0.2 per cent, which would be the third straight monthly increase.

In the U.S., existing home sales on Wednesday will likely show a modest uptick of 0.4 per cent, according to census expectations from BMO, partly as a result of improved credit conditions.